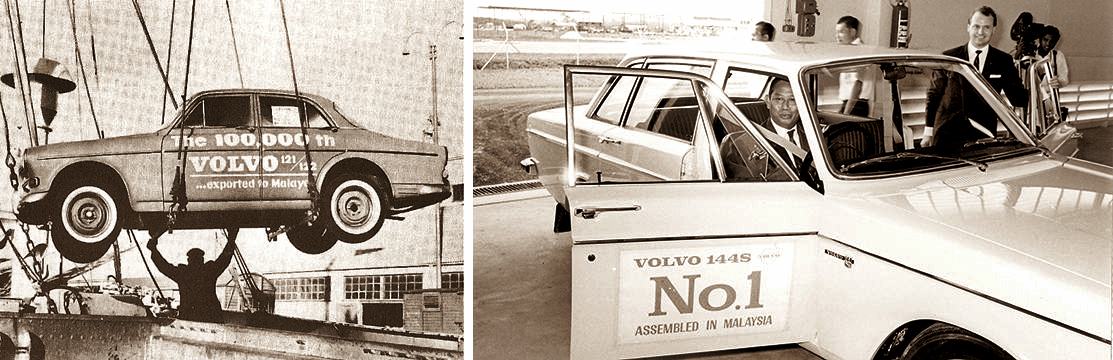

In the mid-1960s, the Malaysian government took the first steps to develop a domestic automotive industry as one way to industrialise the country faster. Its approach was to encourage automakers to make their vehicles in this country, transferring technology and creating jobs as well as boosting the economy.

How Malaysia attracted automakers

To do so, incentives were provided where vehicles assembled locally would be subject to lower tax rates than those imported completely built-up (CBU in industry-speak). The difference in tax rates would enable the locally-assembled models to be cheaper and therefore more attractive to buyers and sell in bigger numbers.

So what President Trump has done to tax imported vehicles more as a way to force automakers to build them in America is not something unusual or new – Malaysia started doing it 60 years ago!

A number of automakers responded positively during the second half of the 1960s, and made investments in assembly plants. That strategy has remained in place up till today, with CBU vehicles being taxed heavily while locally-assembled vehicles enjoy lower taxes.

And over time, the government has modified the incentives to make Malaysia a more attractive place for automakers by offering extra incentives if they can also meet certain conditions. For example, those vehicles that are qualified as Energy Efficient Vehicles also get a bit of extra incentives and those with more locally-sourced parts will also get more incentives. All these help to offset production costs, enabling retail prices to be lower.

Assemble locally to grow

With the strategy having been in places for 6 decades, automakers have long known that if you want to grow your business in this market, you must assemble locally. Not doing so means that you won’t be able to price competitively and growth in volumes will be a struggle.

This has been apparent to the new wave of Chinese automakers coming into the market in recent years. While Chinese factories have huge production capacities and the automakers don’t really need to make their vehicles elsewhere, they do so because of the ‘protectionist’ policies in some countries.

Some automakers like Chery, China’s biggest passenger vehicle exporter for years, have been quick to start assembling locally. Others have been testing various models to see what is popular and have then considered local assembly because they want to grow.

And those that have been selling EVs also have to make a big decision to assemble locally since the government’s duty-free exemption ends on December 31, 2025 and those which are not assembled locally will be subject to the high CBU taxes from 2026. Those which are assembled locally get another 2 years of duty-exemption.

SAIC Motor Malaysia, which handles the MG brand, is one of the companies that has made a decision to start assembling locally during the first half of 2026. Actually, SAIC was one of the early Chinese brands to being local assembly in the ASEAN region, having set up a plant in Thailand some years back.

Contract assembly

However, for assembly in Malaysia, it will not be building its own plant and instead use contract assembly provided by EP Manufacturing Berhad (EPMB) which set up a new plant in the HICOM Pegoh Industrial Estate in Melaka last year.

The plant (Peps-JV Melaka Sdn Bhd), which will have a production capacity of up to 30,000 vehicles annually, currently assembles the HAVAL H6 Hybrid for GWM Malaysia and was supposed to also assemble vehicles for BAIC but that brand has gone quiet.

Malaysia’s strong potential

Emory Qi, Managing Director of SAIC Motor Malaysia, highlighted several factors that make Malaysia the ideal location for local assembly. He noted the 50-year friendship between Malaysia and China which provides a strong foundation of trust and collaboration, while Malaysia’s strategic location within ASEAN positions it as a natural hub for regional distribution and growth.

“Today’s announcement is only the beginning,” said Mr. Qi. “Together with our partners and local talent, we are building a future where innovation, sustainability, and opportunity drive Malaysia forward with MG. Local assembly will be a key milestone that brings us closer to customers while reinforcing our role as a regional hub for MG.”

![MGS5 EV [2025]](https://www.motaauto.com/wp-content/uploads/2025/04/MGS5-EV-2025-5.jpg)

From various remarks made during the announcement, it seems likely that the first locally-assembled model will be the fully electric MGS5 EV, one of the 5 models currently in the brand’s line-up locally. This aligns with SAIC Motor’s vision of a green energy vehicle roadmap presented at Auto Shanghai 2025.